Why American Express Cards Are the Best

Share

American Express has earned a distinguished reputation over the years. Unlike conventional banks that provide a wide range of services, Amex has carved its niche as a credit card issuer, payment processor, and travel services provider. While they have started venturing into full banking services by offering somewhat limited checking and savings accounts, there is room for improvement in this area. But when it comes to credit cards, in our opinion Amex is undeniably a winner.

Among the numerous great features Amex offers, let's focus on three of them.

Premium Benefits and Rewards.

American Express is renowned for its generous rewards programs and premium benefits. Card members enjoy access to an array of exclusive perks, such as airport lounges, concierge services, travel insurance, purchase protection, and exclusive event invitations. These offerings surpass what most conventional banks provide with their credit cards, adding significant value to the Amex experience. Whether it's enjoying a peaceful stay in a business lounge with The Platinum Card, experiencing a dream vacation in the Maldives at a substantial discount (sometimes up to 90%) with the Hilton Aspire card, or getting a 6% cashback on your groceries with the Blue Cash Preferred card, Amex will always make your day.

Customer Service.

Amex is renowned for its exceptional customer service. You can expect prompt, knowledgeable assistance from Amex representatives, that resolve any issues or inquiries efficiently without delay. In contrast, conventional banks, including some of the top ones, often have robot-like agents who do not bother to understand your question, or worse, they struggle to communicate in decent English. After enduring a long 20-minute wait on the phone for an operator to answer, the frustration only compounds. Fortunately, Amex does not have such problems, and their customer service experience consistently receives a 5-star rating.

Credit Limits.

American Express offers the most generous credit limits, even for first-time users. What's more, once you become an Amex cardholder, the likelihood of encountering hard inquiries for future cards or credit limit increases almost disappears. All your new credit cards and credit limit increases will be made with a soft pull, a huge advantage for customers seeking to expand their credit portfolio.

Pro tip: Did you know that in 90 days after receiving your Amex card, you can request a triple credit limit increase? Amex is highly likely to approve it.

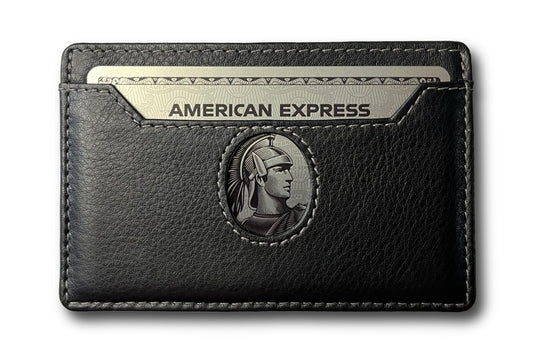

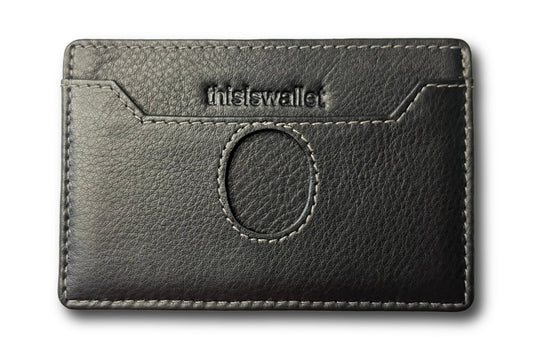

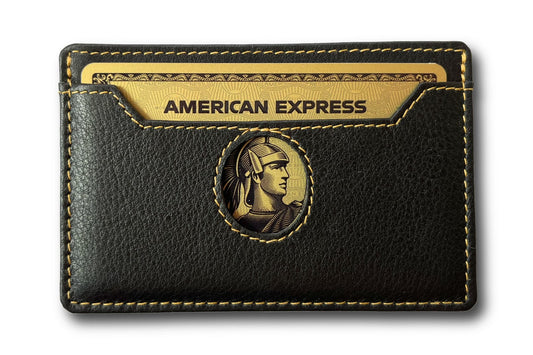

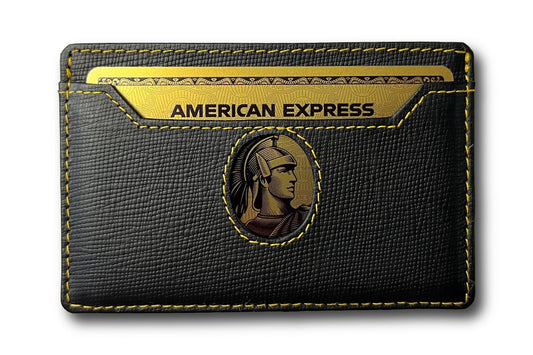

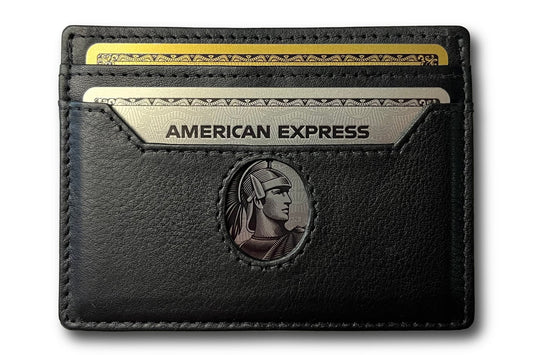

Beyond the impressive features, Amex's card designs have become iconic. We are absolutely enamored with the design of American Express cards, particularly The Platinum Card and the Gold Card – they are simply incredible. The premium feel of these cards makes them stand out in a league of their own.

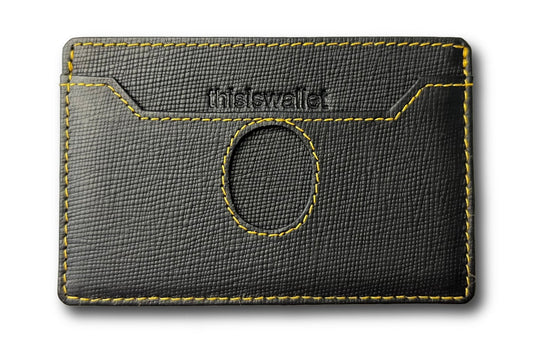

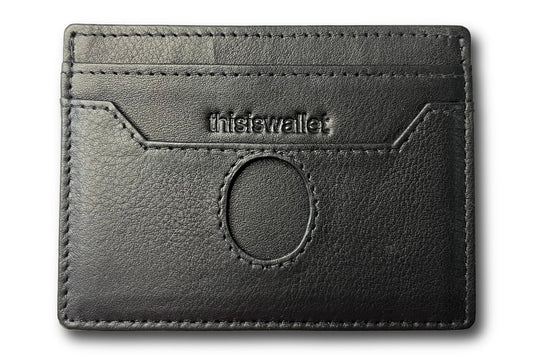

In fact, our admiration for these cards led us to create a unique card holder that lets you beautifully display them in all their glory, giving you a sense of pride every time you use them.

If you haven't had the chance to see our custom card holder yet, we invite you to check it out here.

American Express cards have earned their reputation as the best in the industry for several compelling reasons. From their unmatched premium benefits and rewards to exceptional customer service and generous credit limits.

If you already own an Amex card, complement it with one of the cardholders available for purchase here.

If you do not have an Amex yet, you should definitely consider getting one.

2 comments

Hi Peter, I know it may sound unreal. I will create a new post regarding this soon.

90% discount with the Hilton Aspire Card? I mean, 90% off sounds too good to be true! Can you elaborate?