Maximizing Credit Card Rewards: A Traveler's Guide to Earning and Redeeming Points

Teilen

Are you a frequent traveler looking to make the most of your credit card rewards? With the right strategy, you can earn valuable points and redeem them for unforgettable travel experiences. In this comprehensive guide, we'll explore the best ways to maximize your credit card rewards and turn your everyday spending into incredible adventures.

Choose the Right Credit Card

The first step in maximizing your credit card rewards is selecting the right card for your needs. Look for a card that aligns with your spending habits and offers generous rewards on travel-related purchases. Some top options include:

1. American Express Platinum Card:

Earn 5x points on flights booked directly with airlines or through American Express Travel, and enjoy a host of premium travel benefits.

2. American Express Gold Card:

Earn 4x points at restaurants worldwide and on U.S. supermarket purchases (up to $25,000 per year), making it perfect for foodies and frequent diners.

When choosing a credit card, consider factors like annual fees, foreign transaction fees, and the value of the rewards points earned.

Maximize Your Everyday Spending

To accumulate rewards points quickly, use your credit card for everyday purchases like groceries, gas, and dining out. Many cards offer bonus points in specific categories, so align your spending with those categories to earn more points.

For example, if your card offers bonus points on dining, use it to pay for your meals at restaurants. If you have a card that rewards grocery purchases, use it for your weekly shopping trips.

Take Advantage of Sign-Up Bonuses

Many credit cards offer generous sign-up bonuses to new cardholders who meet a minimum spending requirement within a specific timeframe. These bonuses can be a great way to jumpstart your rewards balance.

Before applying for a new card, make sure you can comfortably meet the spending requirement without overstretching your budget. Also, be mindful of the credit score impact when opening new accounts.

Use Credit Card Shopping Portals

Many credit card issuers have online shopping portals where you can earn bonus points for purchases made through their partner retailers. Before making an online purchase, check if your credit card has a shopping portal and if the retailer you're buying from participates.

By using these portals, you can earn additional points on top of the rewards you already earn with your card, further boosting your rewards balance.

Redeem Points Strategically

When it comes time to redeem your hard-earned rewards points, be strategic to get the most value. Consider the following options:

-

Transfer Points to Airline and Hotel Partners: Many credit card rewards programs allow you to transfer points to partnered airline and hotel loyalty programs. By transferring points, you can often unlock higher-value redemptions, such as luxury hotel stays or international business class flights.

-

Book Travel Through Credit Card Portals: Some credit cards offer bonus points or discounted rates when you book travel through their dedicated travel portals. Compare the prices and rewards earned to booking directly with the airline or hotel to ensure you're getting the best deal.

-

Redeem for Statement Credits: If you prefer simplicity, you can redeem your points for statement credits to offset your travel purchases. While this option may not always provide the highest value per point, it offers flexibility and ease of use.

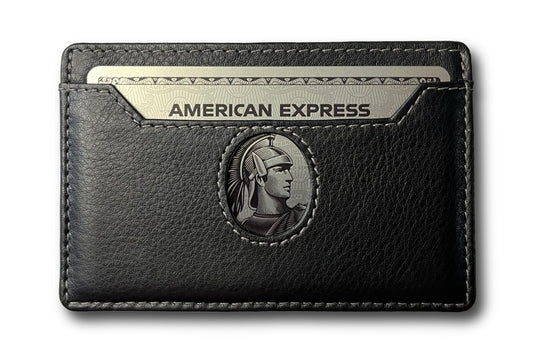

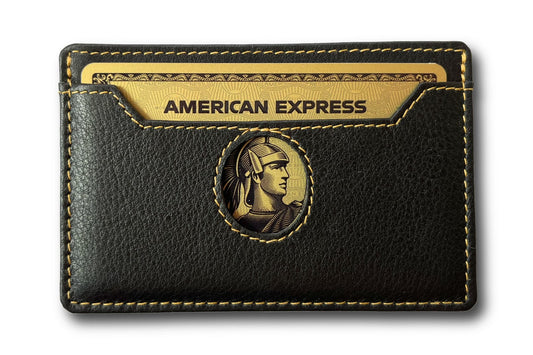

Pair Your Rewards with the Right Wallet

To make the most of your credit card rewards, it's essential to have a wallet that complements your card collection. Consider these options from our collection of wallets for Amex cardholders:

-

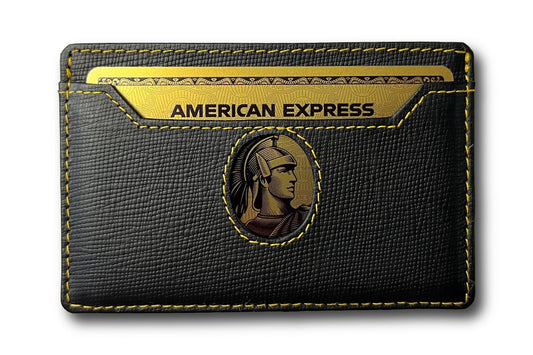

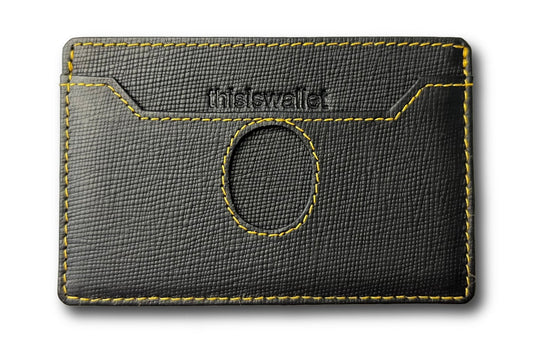

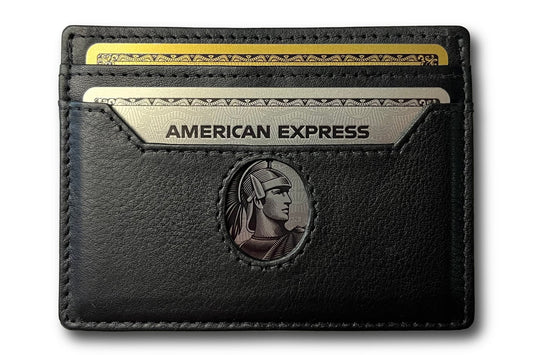

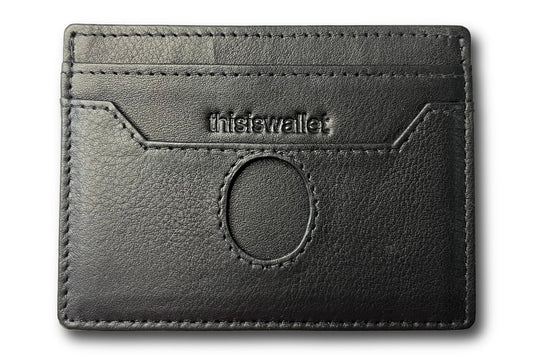

Small Wallet for Men - Amex Wallet - American Express Platinum Card Holder

-

4-Card Minimalist Wallet - Amex Platinum Centurion

-

2-Card Smallest Minimalist Wallet for Amex Platinum

These wallets are designed to securely hold your credit cards while maintaining a sleek and minimalist profile, perfect for the modern traveler.

Stay Informed and Adapt

The world of credit card rewards is constantly evolving, with new cards, benefits, and promotions appearing regularly. To maximize your rewards, stay informed about the latest offerings and be prepared to adapt your strategy as needed.

Follow travel and credit card rewards blogs, subscribe to newsletters, and regularly review your card's benefits and earning potential to ensure you're always getting the most value.

Final Thoughts

Maximizing credit card rewards can be a game-changer for travelers looking to elevate their experiences without breaking the bank. By choosing the right card, aligning your spending with bonus categories, and redeeming points strategically, you can turn your everyday purchases into unforgettable adventures.

Don't forget to pair your rewards strategy with a high-quality minimalist wallet to keep your cards organized and secure on your travels.

Start maximizing your credit card rewards today and unlock a world of incredible travel opportunities. Happy travels and happy earning!